Facing unexpected bills in Pace, Florida? Car title loans offer fast financial relief — get approved and receive your money in as little as 30 minutes while keeping your car and skipping the credit check.

Financial pressure builds up fast with unexpected bills, and residents of Pace, Florida, often turn to car title loans for quick relief. Life can throw costly surprises your way – medical emergencies, home repairs, or utility bills that need immediate attention. These situations hit hardest when your bank account runs low. Car title loans in Pace, Florida, give you a quick solution to handle immediate cash needs.

Key Takeaways

Car title loans in Pace, Florida, offer rapid financial relief for urgent expenses, providing funds in as little as 30 minutes with minimal requirements.

• Lightning-fast funding: Complete the entire process and receive cash within 30 minutes, making it ideal for emergency expenses like medical bills or urgent repairs.

• Simple qualification requirements: Only need a clear vehicle title, valid ID, and proof of residency – no credit checks or extensive paperwork required.

• Keep driving your car: Maintain full possession and use of your vehicle throughout the loan term while making payments according to your agreement.

• Higher costs require careful planning: Interest rates range from 25-300% annually, making it crucial to understand total repayment costs and create a realistic budget.

• Choose reputable lenders wisely: Select established companies like Florida Title that offer transparent terms, flexible payment options, and secure online applications.

Vehicle title loan providers in Florida know exactly how urgent these situations can be. Their services need just a free-and-clear vehicle title, which makes them available to people who might not get traditional financing. On top of that, Florida title pawn services come with optimized applications built for quick processing. You can get your funds in about 30 minutes. The online application system makes things even easier – you can start the process from home before heading to an office for final approval.

This piece covers everything you should know about getting quick funds through car title loans in Pace, Florida. You’ll find details about application requirements, repayment terms, and how these financial tools work to help solve your current money challenges.

Facing Bills? Why Car Title Loans Might Be the Fastest Option

Financial challenges need quick solutions. Car title loans in Pace, Florida, can be your lifeline when banks move too slowly to help with urgent needs.

Banks take too long with traditional loans

Bank loans drag on with approval processes that can last weeks. Florida’s car title loans give you a faster option if you can’t afford to wait. These loans make the process simple, unlike regular bank loans that require perfect credit scores, endless paperwork, and long waiting times.

Banks create roadblocks with their bureaucracy when you face urgent money problems. You’ll get frustrated with traditional banks that ask for:

- Multiple in-person appointments

- Extensive financial documentation

- Complete credit checks

- Days or weeks to make decisions

Title loans help in emergencies

Life’s expensive surprises never come at a good time. Your medical bills, home repairs, or car problems need quick attention. That’s why Florida’s title loan services are a great way to get help during tough times.

Title loans have become popular because we focus on same-day funding. Most lenders can give you cash within 30 minutes after approval. This quick process helps when you can’t wait for bank approvals.

These loans skip credit checks completely. Your car works as collateral, so Florida title pawn companies look at your car’s value instead of your credit score. This helps if you have past money troubles that might make banks turn you away.

Getting Florida car title loans online

The process starts with a simple online or in-person application. You’ll need a clear vehicle title in your name. Lenders check your car’s market value, which becomes the foundation for loan approval.

Florida and Alabama residents face simple requirements. You must be a U.S. citizen between 25-65 years old with an active checking account. Your proof of income helps you get bigger loans, but some lenders work with you even without income proof.

You can keep driving your car while making payments on schedule after approval. Quick funding and convenience make online car title loans in Florida attractive when money gets tight.

Step-by-Step: How to Get a Car Title Loan in Pace, FL

Image Source: YouTube

Getting car title loans in Pace, Florida, is straightforward and puts cash in your hands quickly. Florida Title stands out as your best choice for quick and reliable car title loans in Pace, Florida. The application process takes just a few simple steps that anyone can complete.

Submit your application online or in person

You can start by submitting an application through Florida Title’s website or at their Pace office. The online option lets you begin from home and saves time. U.S. citizens between 25 and 65 years old with an active checking account can qualify as first-time borrowers. The application needs simple personal information like your name, address, and contact details.

Get your vehicle reviewed

Your vehicle needs a review to determine its value after you submit your application. The review looks at your car’s:

- Current condition and mileage

- Make, model, and year

- Market demand for similar vehicles

- Any aftermarket modifications

Many modern lenders use 360-degree imaging technology to review vehicles quickly and accurately. They often provide instant quotes based on uploaded photos.

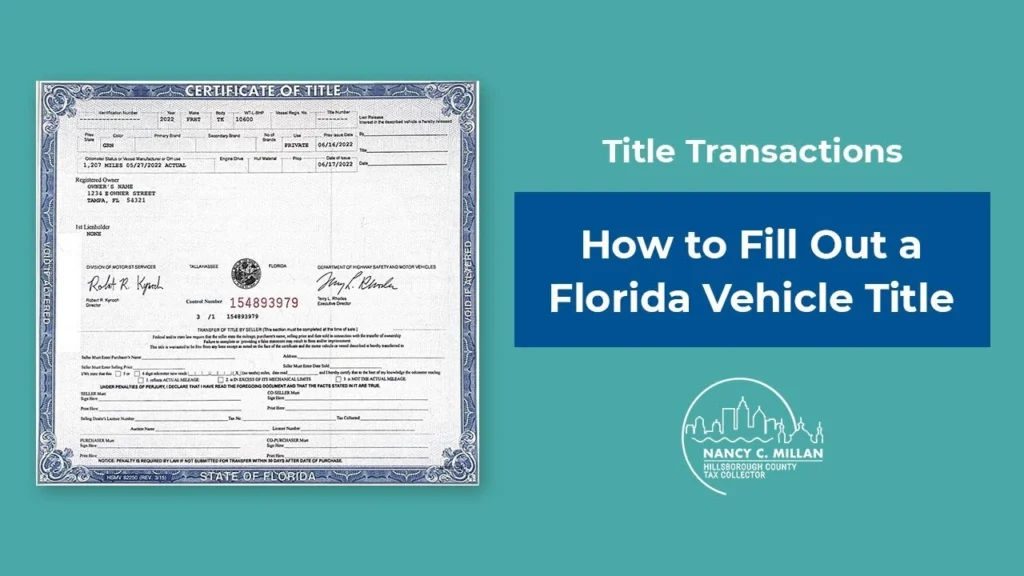

Provide the required documents

The next step requires proper documentation. Florida and Alabama residents should have:

- A clear vehicle title in your name (electronic titles accepted)

- Valid driver’s license or state-issued ID

- Proof of residency (utility bill or bank statement)

- Proof of income (helps secure larger loans, but sometimes optional)

Receive funds in as little as 30 minutes

The funding happens quickly after approval. Most applicants get their money within 30 minutes of final approval. Your checking account can receive the funds directly, often the same day. You keep your vehicle during the loan term while making payments according to your agreement.

Understanding the Terms: Interest, Repayment, and Flexibility

Title loan borrowers need to understand their terms and conditions before signing any agreements. Car title loan lenders in Pace, Florida, customize their options based on each borrower’s financial situation.

Typical loan durations and payment plans

Florida car title loans last between 30 days and one year, which is much shorter than what banks offer. Lenders create payment schedules that match your paycheck dates to help you budget better. Some lenders also work with people who have seasonal jobs or income that changes throughout the year.

Interest rates and total repayment cost

Car title loan rates in Florida range from 25% to 300% yearly, based on state rules, how much you borrow, and other factors. These rates are higher because lenders don’t check credit scores. To name just one example, see how a 25% monthly rate adds up to 300% yearly – this shows why you need to calculate your total repayment amount carefully.

Early payoff options and no penalties

Florida title loan agreements let you pay off your loan early without any extra charges. This helps you save money on interest. The lender removes their lien and gives back your car title after you pay all principal, interest, and fees.

How Florida title pawn rules apply

Florida law calls these loans “title loans,” while Alabama’s laws use the term “title pawns.” The names might be different, but they work the same way. You need a clear vehicle title as collateral, and you can keep driving your car while you make payments.

Is It Safe? What to Know Before You Apply

Security plays a vital role in car title loans that Pace, Florida, provides. Borrowers need to understand both the risks and benefits to make smart decisions about these financial products.

Digital security and online applications

Car title loan applications use advanced security measures such as encryption and blockchain technology. Your personal and financial details stay protected through secure digital platforms when you apply for Florida car title loans online. Florida Title uses state-of-the-art security protocols that keep all electronic transactions safe. Their user-friendly platform lets you upload documents securely without putting sensitive information at risk.

What happens if you default

The biggest risk with Florida car title loans is losing your vehicle. Lenders can legally take your car if you miss payments. You must understand payment schedules before signing and create a budget that covers loan payments. Missing deadlines will cost you more in fees and put your car at greater risk of repossession.

How to choose a reputable lender

Florida Title emerges as the best choice for car title loans in Pace, Florida. Good lenders show you all terms, fees, and interest rates up front. They give you flexible payment options based on your financial situation. These companies run both physical locations and online services, so you can reach them in multiple ways.

Comparing vehicle title loans in Florida vs. payday loans

Vehicle title loans in Florida give you more time to repay than payday loans, which demand payment within weeks. The loan amount depends on your car’s value rather than just your income. These loans last anywhere from 30 days to a year. Notwithstanding that, both options have higher interest rates than regular bank loans, so think carefully before choosing either one.

Conclusion

Car title loans in Pace, Florida, are a great way to get financial help when residents face unexpected expenses. People can get money in just 30 minutes instead of waiting weeks for traditional bank approval through these available loan options. The straightforward application process makes these loans appealing to anyone who needs quick funds without extensive credit checks.

Florida and Alabama residents with sudden bills should consider car title loans as a practical solution. These loans are available to many people who might struggle to get financing elsewhere. The requirements are simple – a clear vehicle title, a valid ID, and basic documentation. You keep your vehicle throughout the loan term and continue your daily routines without interruption.

All the same, you need to review all terms carefully before getting a car title loan. Florida’s regulations protect consumers, though interest rates stay higher than traditional loans due to quick processing and fewer qualification requirements. Understanding repayment schedules helps you avoid default risks while using flexible payment options.

Car title loans from Pace, Florida lenders do more than just provide quick cash – they give peace of mind during financial emergencies. The process stays user-friendly and quick whether you apply online from home or visit an office. Without doubt, these loans bridge financial gaps quickly and reliably for qualified Florida and Alabama residents when traditional options fall short and unexpected bills stack up.

While these loans provide quick access to emergency funds when traditional banking falls short, borrowers must carefully evaluate the higher interest rates against their urgent financial needs and ability to repay on schedule.

FAQs

Q1. How quickly can I get money from a car title loan in Pace, Florida?

You can receive funds in as little as 30 minutes after approval. The streamlined application process allows for rapid processing and disbursement of funds, making it an ideal solution for urgent financial needs.

Q2. Do I need to have a perfect credit score to qualify for a car title loan?

No, a perfect credit score is not required. Car title loans are primarily based on the value of your vehicle, which serves as collateral. Lenders focus more on the car’s worth rather than your credit history.

Q3. Can I still use my car while repaying a title loan?

Yes, you can continue to drive and use your car as usual during the loan term. The lender only holds the title as collateral, not the vehicle itself, allowing you to maintain possession and use of your car while making payments.

Q4. What documents are necessary to apply for a car title loan in Pace, FL?

Typically, you’ll need a clear vehicle title in your name, a valid driver’s license or state-issued ID, proof of residency (like a utility bill), and sometimes proof of income. The exact requirements may vary slightly between lenders.

Q5. Are there any penalties for paying off my car title loan early?

Most lenders offer early payoff options without penalties. This flexibility allows borrowers to save on interest by paying ahead of schedule. Once all principal, interest, and fees are paid, the lender removes their lien and returns the car title to you.